Since the great cryptocurrency boom and bust of 2017/18, I basically didn’t touch my holdings. Mainly I didn’t have the spare cash to speculate on Bitcoin, but a part of me was also exhausted by the constant cycles of hype and disappointment.

Hopefully I don’t regret my inability to buy more Bitcoin between 2018 and 2020 too much when I’m old(er).

Anyway… my wife recently sent me an article that piqued my interest in the cryptocurrency space all over again.

It originally ran on Moneyweb, but there is an un-paywalled version on the writer’s personal site: Crypto pioneer buys a R600k house with crypto and it ends up costing R200k | The Writer's Room

Here’s the YouTube video the article is based on:

Richard de Sousa’s talk got me interested in this burgeoning new Decentralised Finance (DeFi) space.

A whole banking ecosystem is starting to evolve on Ethereum including lending, and investment funds (managed, indices, all sorts!).

Except what DeFi is doing is lowering the barrier to entry into the space. You still need a sizeable sum of money to meaningfully participate, it looks like to me, but it has the potential to democratise banking services in a big way.

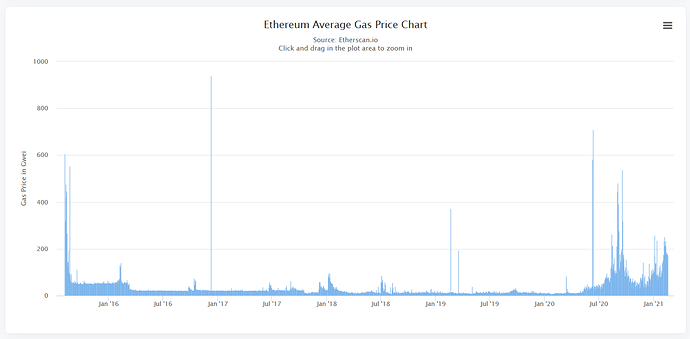

There are other big barriers to entry — being technologically inclined and having time to burn are two major ones off the top of my head — not to mention the ridiculous transaction costs on the Ethereum blockchain at the moment because of the bull run happening at the moment.

This weekend I set about trying to figure out how to actually use these emerging DeFi platforms and aside from the Ethereum transaction fees it was a lot of fun.

Have any of you dabbled (or made fortunes) in DeFi?

… pretty much in the same boat as the guy in the video: the banks won’t loan me the amount I need because my total bond repayments would be more than “30%” of my income (due to covid, they exclude over half of my rental income), so in order to qualify, I must first sell my current house which is not ideal.

… pretty much in the same boat as the guy in the video: the banks won’t loan me the amount I need because my total bond repayments would be more than “30%” of my income (due to covid, they exclude over half of my rental income), so in order to qualify, I must first sell my current house which is not ideal.